What is homeowners insurance subrogation?

3/4/2021 (Permalink)

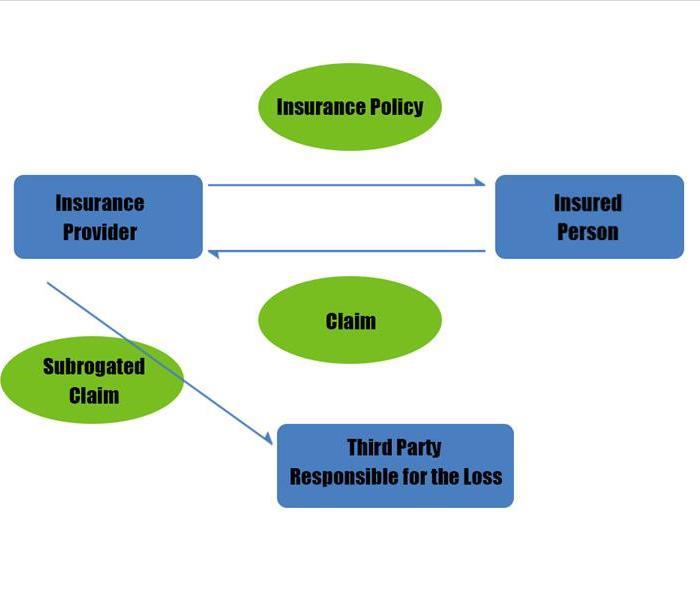

Subrogation, the substitution of one's rights to another, enables the insurance company to make a claim against the manufacturer or installer of the furnace to recover the money the insurance company paid to re-build your house.”

Imagine opening the door to your condominium (“condo”) only to be confronted by several inches of standing water. The first call is to your insurance company, which must then consider not only mitigating, adjusting and paying the claim, but subrogating against those responsible for the loss. Determining who is liable for such damage can be tricky and it depends on the source of the water. Condo associations carry insurance to cover common areas while individual condo owners carry coverage covering the interiors of their units, including the walls, flooring, and contents. A toilet supply line may have failed. The bathtub may have been left running in the unit above. Faulty construction or renovations may have allowed rain to infiltrate and cause damage. A washing machine next door may have failed. Regardless the cause, however, an even bigger obstacle may be overcoming state law and certain declarations intended to bar one unit owner (or his/her insurance carrier) from suing/subrogating against another unit owner. Knowing the law in this area from state to state becomes critical in evaluating subrogation potential.

24/7 Emergency Service

24/7 Emergency Service